Holiday Pay And Overtime In Same Week California

To compute overtime on a production bonus the production bonus is divided by the total hours worked in the bonus earning period. Your state for example California may require.

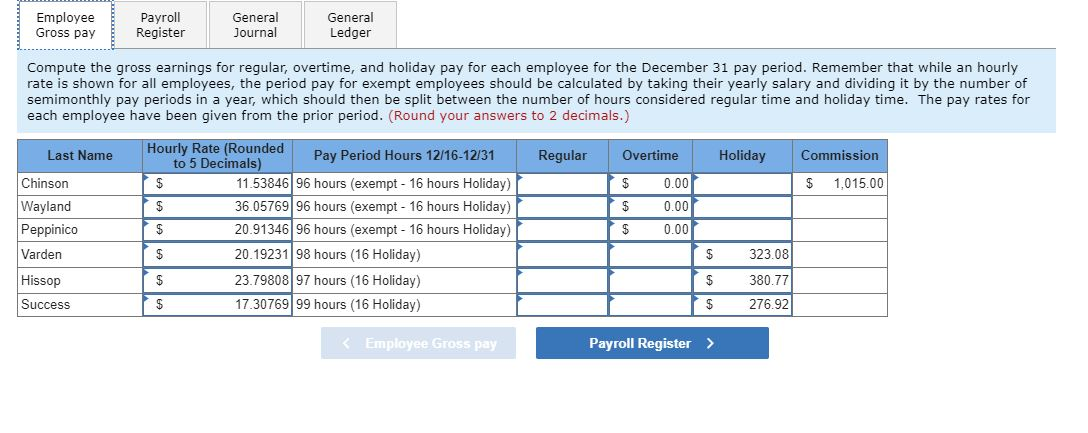

December 31 The Final Pay Period Of The Year Will Not Chegg Com

If your employees are entitled to overtime calculating pay can be a bit tricky.

Holiday pay and overtime in same week california. This is true even if the employee commutes to work in a ridesharing program that the employer provides105 If traveling to work on employer-provided transportation is mandatory however commuting time will be considered hours worked and the employee is be. If you do pay holiday pay how do you handle overtime for eligible employees. Likewise there is no requirement that employers pay employees extra pay or holiday pay for work performed on holidays.

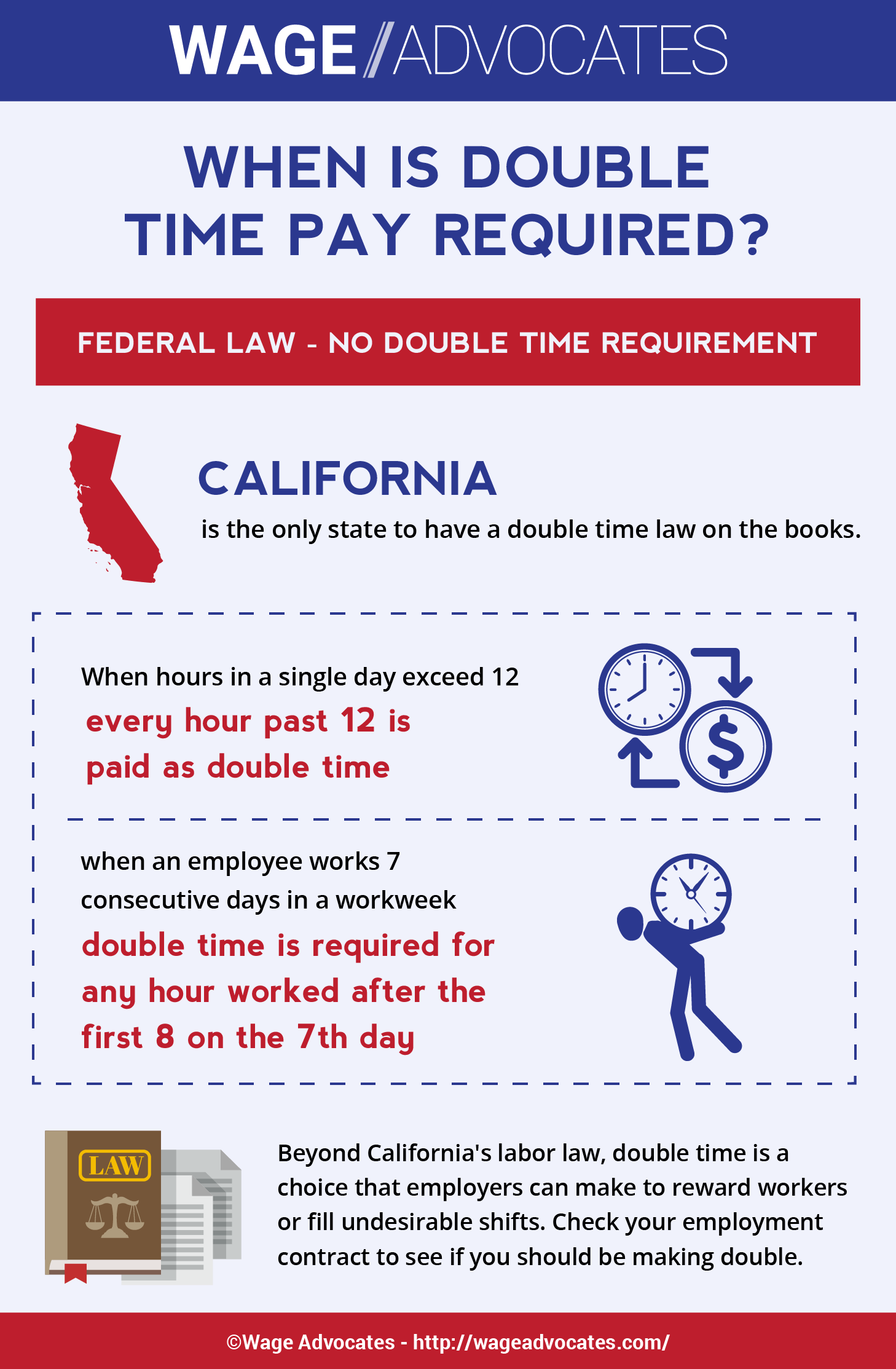

Overtime wages are a type of increased payment that employees can earn when they work more than a certain number of hours in a workday or workweek. 15x hourly rate for the first 8 hours on the seventh consecutive day of work. Also at this point any hours worked should be 15x pay since it is now all overtime hours.

The amount of overtime depends on the length of the employees shift and the number of days he or she. Home Uncategorized holiday pay and overtime in same week california Sep Wed 9th 2020 Posted in. 2x hourly rate for work over 8 hours on the seventh consecutive day of work.

Holiday premiums will be counted as overtime premiums that might be due for overtime hours on the holiday or during the holiday week. Holiday pay and overtime in same week california. If an employee works 36 hours from Monday through Thursday and you give everyone Friday July 3rd off you are not required by federal law to pay overtime.

Unless your employer has a policy or practice of paying a premium rate for working on a holiday or you are subject to a collective bargaining or employment agreement that contains such a term your employer is only required to pay. If an employee works 36 hours from Monday through Thursday and you give everyone Friday July 3 off you are not required by federal law to pay overtime. How much is holiday pay.

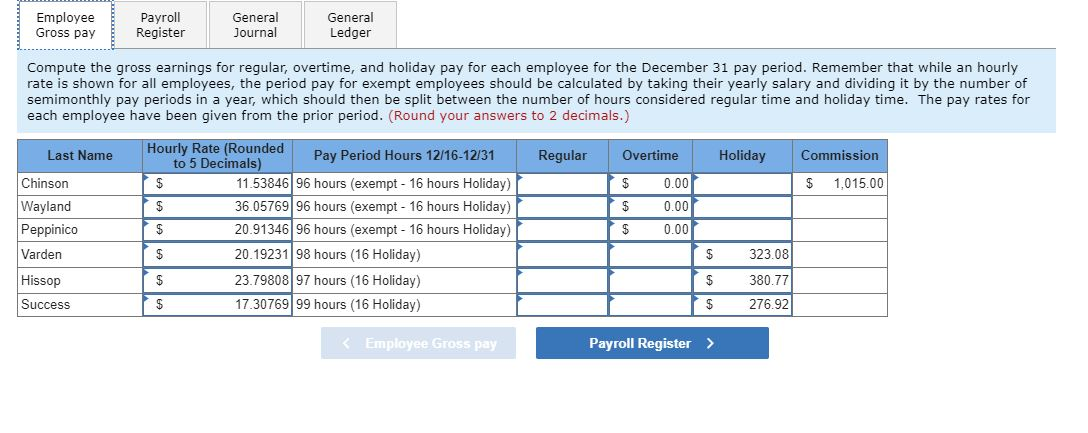

Another example of where you get paid your regular wages but the time is not counted towards overtime is if you get paid for a holiday. Federal wage and hour law requires that overtime is paid to non-exempt employees for all hours worked over 40 in a workweek. The key word here is worked Holiday pay is not considered hours worked so it does not go into an overtime calculation.

So now they have hit 40 hours for the week and 087 hours of additional OT. Where an employer agrees to pay employees premium pay for holiday work the employer is not required to pay overtime based on the premium rate if the employees work more than 8 hours in a day or 40 hours in a week the California Court of. The important thing to know is that under federal law overtime is calculated weekly.

Only 021 hours of normal OT pay. At this point the paycheck should show 923 hours of 15x federal holiday pay 087 hours of 15x OT pay. Where an employer agrees to pay employees premium pay for holiday work the employer is not required to pay overtime based on the premium rate if the employees work more than 8 hours in a day or 40 hours in a week the California Court of Appeal ruled.

Only hours actually worked count toward overtime when determining if employees are owed time and a half for hours over 40 in a workweek. If an employee works 36 hours from Monday through Thursday and you give everyone Friday July 3rd off you are not required by federal law to pay overtime. California employers are not required to pay for time off for holidays nor are they required to pay additional wages if employees work on holidays.

At the federal level overtime needs to be paid only for hours worked in excess of 40 in a workweek. Holiday pay is not considered hours worked so it does not go into an overtime calculation. This means that an employee may be paid for 48 hours but if eight of those were holiday pay all hours can be paid as straight time since only 40 hours were actually worked.

15x hourly rate for work over 8 hours in a workday and 40 hours in a workweek. 2x hourly rate for work over 12 hours in a workday. Holiday pay and overtime in same week california.

This means if your employee works over 40 hours during the week of typical paid holidays like Thanksgiving Christmas or New Years Day they are entitled to time and a half for the hours worked over 40 hours. Most non-exempt employees in California have a legal right to receive overtime wages when they work long hours 1. No you are not entitled to any overtime pay.

0 Comments Prior results do not guarantee a similar outcomeFocused on labor and employment law since 1958 Jackson Lewis PC. Holiday pay and overtime in same week california. Holiday pay is not considered hours worked so it does not go into an overtime calculation.

There is nothing in state law that mandates an employer pay an employee a special premium for work performed on holidays Saturdays or Sundays other than the overtime premium required for work in excess of eight hours in a workday or 40 hours in a workweek. Overtime is calculated based on hours actually worked and you worked only 40 hours during the workweek. Your state for example California may require overtime to be paid for employees who work more than 8 hours in one.

Holiday Pay California An Employer S Guide Hourly Inc

Can Employees Earn Holiday Pay And Overtime Allbusiness Com

Do Vacation Hours Count As Overtime The Timesheets Com Journal

How To Calculate Holiday Pay In The Philippines Holiday Pay October Holidays Holiday

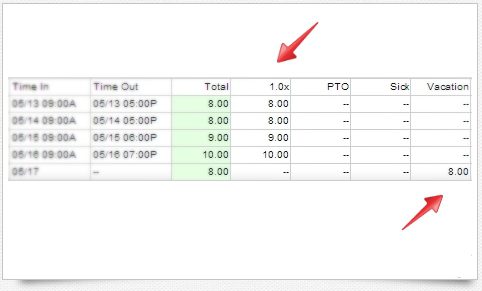

Walmart Offers Thanksgiving Workers Measly Discount In Place Of Holiday Pay Walmart The Guardian

How To Calculate Overtime Pay Easy Overtime Calculator A Basic Guide

What Is Double Time Pay When Is It Mandatory Overtime Lawsuit

Payroll Stub Template Free Download The World Wide Web Is Filled With Bots Around Seeking Poorly Shielded W Pay Stubs Template Payroll Checks Payroll Template

What Is Holiday Pay Free Holiday Pay Policy Template

Know Your Rights Employee Benefits Off In Lieu Paid Leaves Overtime Pay Employee Benefit Annual Leave Know Your Rights

Employee Time Clock With California Overtime

California Employers Association Holiday Pay For Employees

Know Your Rights Job Posting Workers Rights Workplace

Time Off For Holidays And Holiday Pay Under California Law

Do Employers Have To Count Pto Paid Time Off Holiday Vacation Sick Hours Toward Weekly Overtime Ontheclock

2021 California Overtime Law Ontheclock

What You Need To Know Education Center Education Employment

Just Some Of The Ways That The Labor Movement Have Helped U S Workers Retirement Benefits Holiday Pay Labor Law

0 Response to "Holiday Pay And Overtime In Same Week California"

Post a Comment